Last November, my brother called me and he was beside himself with despair. “Dude, you won’t believe what happened with my Cassava Sciences position,” he said. “The stock just collapsed 85% in a single day!” I knew he’d been gambling big on SAVA for months. Pity the guy; he lost 12 grand when their Alzheimer’s drug failed spectacularly in Phase 3 trials. That call still haunts me every time I look at biotech stocks now.

The Brutal Reality Check

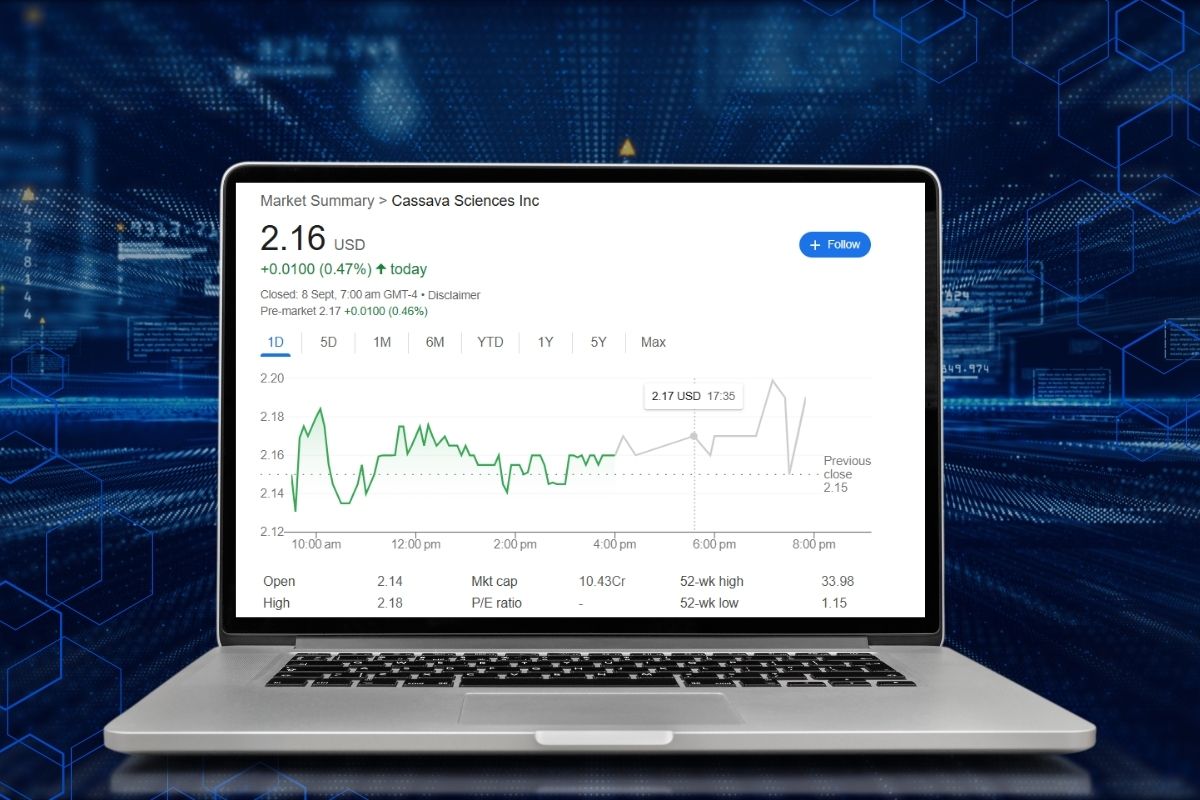

SAVA is now trading at approximately $2.16, which is pretty much rock bottom compared to where it used to be. This company turned from a biotech darling into a cautionary tale quicker than you can say “clinical trial failure.” The wheels began to come off when Cassava Sciences reported that their experimental Alzheimer’s disease drug, simufilam, hadn’t demonstrated that it was working in a phase 3 clinical trial, with volunteers who took the drug performing no better in cognitive or everyday-life activities than those who received a placebo.

What Actually Happened

It wasn’t just a minor setback. The phase 3 ReThink-ALZ trial missed both its co-primary and secondary and exploratory biomarker endpoints, failing on all pre-specified targets, including improvements in cognition, function, neuropsychiatric symptoms, and caregiver burden. That’s the lingo in biotech for “this drug doesn’t work at all.” Ouch. In March 2025, Cassava disclosed that it would halt any further development of simufilam for Alzheimer’s disease and anticipated winding down the program by Q2 2025. Their top moneymaker has left the game.

My Personal Experience with Biotech Disasters

I have been burned by biotechs before, but never this badly. I invested in a company with an interesting-looking diabetes drug in 2019. Two years later, their Phase 2 trials revealed that the drug actually made things worse. I lost about three grand on that particular transaction. So my brother’s SAVA disaster struck close to home. These biotech plays can either make you rich or decimate you. There’s rarely anything in between.

The Numbers Game Right Now

The company ended Q1 with $117.3 million in cash and reported a net loss of $23.4 million. That cash is an impressive-sounding war chest, but with no active drug program, it’s basically just a ticking clock winding down to bankruptcy. Wall Street analysts still have a Buy consensus rating with a price target of $61.17, but honestly, those analyst ratings feel completely out of touch with reality. How do you justify a $60+ price target on a stock trading at two bucks?

The Pivot Strategy

Here’s where things get interesting. Since the failure of its Phase 3 study in Alzheimer’s disease, Cassava is turning its focus to TSC-related epilepsy with a new Yale University license. TSC, or tuberous sclerosis complex, leads to seizures and other neurological issues. It is a much smaller market than Alzheimer’s; maybe that isn’t such a bad thing. Less competition, clearer regulatory pathway.

Sava Stock Reality Check

The Sava Stock situation reminds me of why I try to stay away from single-drug biotech companies nowadays. When your entire business model depends on one experimental medicine, you’re playing Russian roulette with your money. Yes, that one drug may work, in which case you might make 10 times your money. But then, if it bombs the way Simufilam did, you lose nearly everything. That’s what happened to thousands of SAVA investors.

What I’d Do If I Owned Shares

If I were still holding my SAVA shares (mercifully, I’m not), I might just be inclined to take my losses and walk away. The epilepsy pivot might pan out, but it is years away from bearing fruit. And yet that cash pile keeps shrinking each quarter. Some shareholders are still clinging on in the hope of a miracle turnaround. I understand; no one wants to lock in huge losses. But a lot of times you have to know when to fold.

Also Read: GoWild Annual Pass

The Stocktwits Crowd

The retail investors on StockTwits are still pretty active with SAVA discussions. A few are averaging down, buying more shares at these low prices. Some are cutting their losses and moving to different plays. Honestly, it’s depressing to read over those old message boards. Lots of people lost serious money betting their kids’ college funds or retirement savings on this stock.

Lessons Learned the Hard Way

My brother’s SAVA disaster taught both of us some valuable lessons. Never put more than 2-3% of your portfolio in a single biotech stock. These companies can go to zero overnight if their drug trials fail. Also, don’t get caught up in the hype. Social media and message boards were full of people convinced simufilam would revolutionize Alzheimer’s treatment. The science didn’t back up the excitement.

Looking Forward

Could SAVA recover? Maybe. If their epilepsy program shows promising results in a year or two, the stock could bounce back. But that’s a big if, and there are probably better places to put your money right now. The biotech sector is full of companies with multiple drug candidates and diversified pipelines. Why bet on a company that’s essentially starting over from scratch?

Final Thoughts on SAVA

The whole Cassava Sciences story is a perfect example of how quickly things can change in biotech. One day you’re a hot growth stock with a promising Alzheimer’s treatment, and the next day you’re trading for pocket change. My heart goes out to everyone who lost money on this one. Biotech investing is brutal, and SAVA was one of the most brutal examples in recent memory. If you’re thinking about buying SAVA at these low prices, just remember my brother’s phone call. Sometimes rock bottom has a basement.